owe state taxes payment plan

Payment arrangem ents We offer payment plans up to 36 months. What you should know about payment plans.

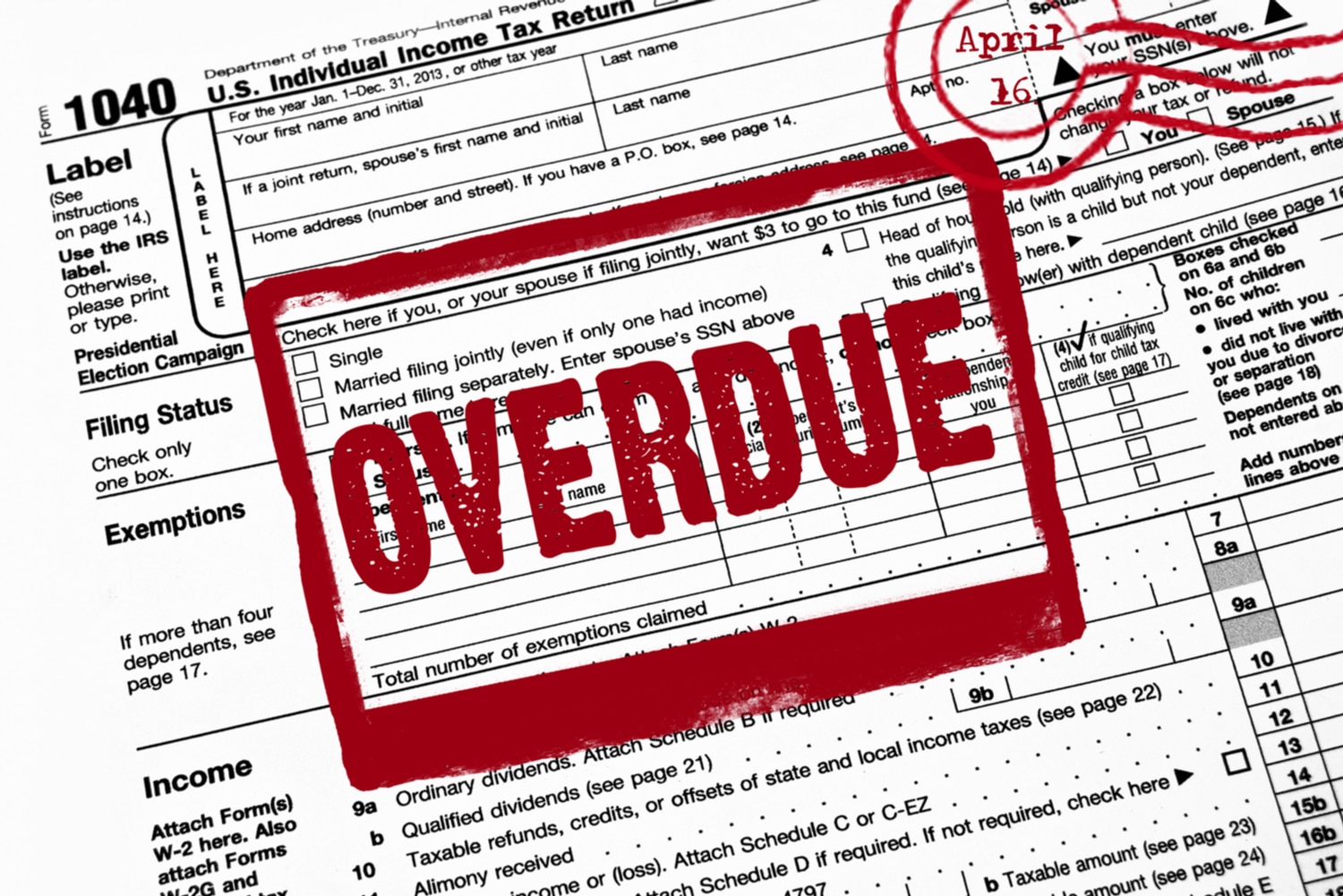

How Much Do I Owe The Irs 4 Ways To Find Out Tax Defense Network

If you owe a tax debt to the Georgia Department of Revenue and cannot afford to pay it all at once you can request an installment payment agreement to settle your debt over time.

. After 60 days a 25 cost of collection fee will be added to your Notice of Tax Due. You can request a payment plan for any unpaid amount including Cigarette Taxes Homestead Benefit and Senior Freeze Property. If you submit an installment agreement request for your tax.

Determine your Balance Owed by adding ALL of your South Carolina Individual Income Tax or GEAR debts. Expand All OPTION 1. Set up a payment plan via INTIME.

Pay what you can by the due date of the return. Payment agreements that include tax debt must. The Department of Revenue will always attempt to work with you in order to pay your debt but you must contact us.

If you do not know your. Phone Call our Collections Department at 8043678045 during regular business hours to speak with a representative. Theres a fee to set up an agreement.

The department may file a Notice of. 077 average effective rate. Call us at 503 945-8200 to discuss your debt and options.

Pay income tax through Online Services regardless of how you file your return. You can also review and manage your payment plan online. You owe 50000 or less in combined tax penalties and interest and filed all.

You can set up a Payment Plan Agreement based on the following parameters. It may take up to 60 days to process your request. Payment Plans for Qualified Applicants Dont ignore your debt.

Long-term payment plan installment agreement. Pay including payment options collections withholding and if you cant pay. Typically you get three to five years to pay your bill.

If you cant pay your tax bill in 90 days and want to get on a payment plan you can apply for an installment agreement. To set up a plan. Please be aware of the following when asking for a payment plan.

Once a tax return has been processed with a. If you are looking to set up a payment plan that is less than 12 months in length and you owe less than 50000 you have a few options. 3610 cents per gallon both of regular gasoline and diesel.

Typically you will have up to 12 months to pay off your balance. If you owe tax or other debt to the Minnesota Department of Revenue and cannot pay in full you may request to make installment payments. To obtain a six-month payment plan you can use the CD-6 Web Application.

With the State of Maryland recurring direct debit program you dont have to worry about mailing off a check for your individual tax payment plan. You may be required to pay electronically. We are unable to set up installment payment agreements on your tax liability until you receive a Notice of Collection from NCDOR.

If you cant afford your tax bill and owe less than 25000 California offers payment plans. In 2013 the North Carolina Tax Simplification and Reduction Act. Pay personal income tax owed with your return.

You can pay or schedule a payment for any. Or if you prefer you can complete the Form CD-6 Payment Agreement Request and then submit the form by. If approved it costs you 50 to set-up an installment.

DOR offers payment plan options for individual income tax customers who owe more than 100. If you are an individual you may qualify to apply online if.

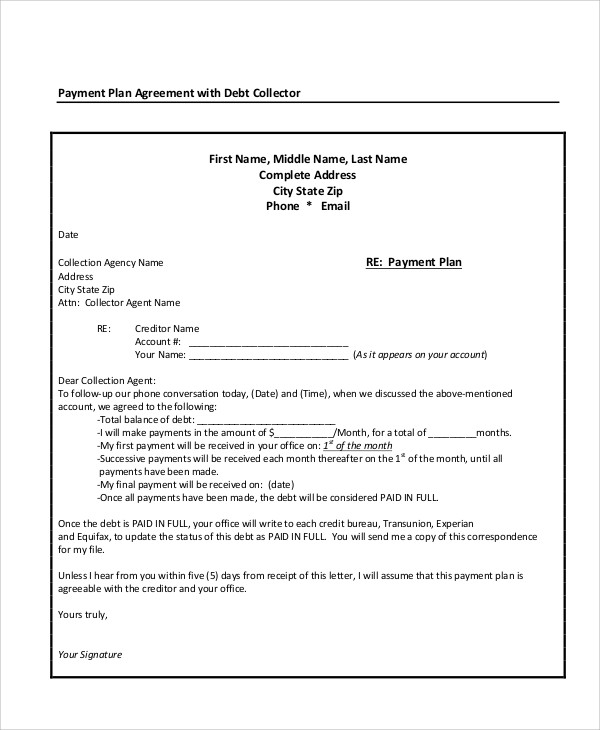

22 Payment Plan Templates Word Pdf Free Premium Templates

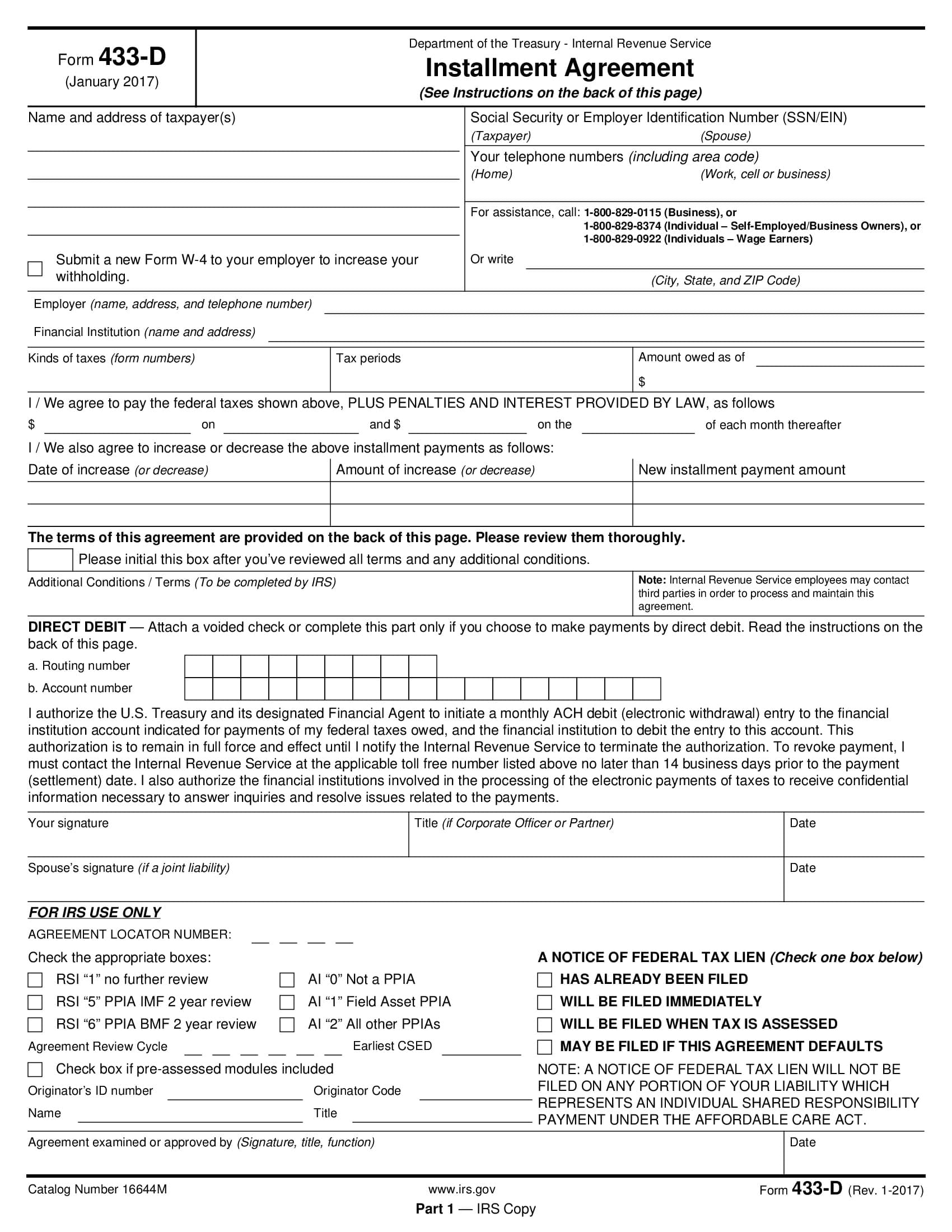

Irs Payment Plan Installment Agreement Options Nerdwallet

New Jersey Irs Payment Plans Attorney Paladini Law Jersey City

Collection Tools The Irs Or State Can Use When I Owe Taxes

Facts About Irs Payment Plans Turbotax Tax Tips Videos

Can You Have Two Installment Agreements With The Irs Polston Tax

Irs No Penalty For Filing Taxes Late If You Re Getting A Refund

Irs Letter 2840c Installment Agreement H R Block

Strategies For Minimizing Estimated Tax Payments

Connecticut State Tax Payment Plan Options And How To Apply

Dor Owe State Taxes Here Are Your Payment Options

Payments Internal Revenue Service

Can I Pay Taxes In Installments

4 Steps To Pay Off Your Income Tax Bill Irs Tax Bill Taxact

Texas State Tax Payment Plan Options How To Apply

Owe The Irs You Have A Few Options If You Cannot Afford The Bill Forbes Advisor

When Are Taxes Due In 2022 Here Are All The Major Deadlines Money